What is De-Risking?

Every organisation in the financial industry must be up to date on compliance requirements as well as new updates, regulations, and trends in this field.

Although monitoring the regulatory developments in this sector is repetitive and time-consuming, failing to do so results in non-compliance with the new regulations. Failure to follow regulations can also harm an institution’s reputation, cost its clients, and result in harsh fines from regulators.

Therefore, institutions must develop the proper AML-CTF compliance programmes. On the other hand, de-risking is a tactic that businesses use when they are unable to manage the money laundering risks that they are required to handle. In other words, the financial or reputational cost of providing AML/CFT compliance is too high to justify beginning or maintaining a particular high-risk customer connection (for instance, a relationship with a politically exposed person).

Increasing compliance spending, creating new remediation processes, or even taking the more drastic measures of limiting or ending business contacts are just a few of the de-risking AML strategies that firms might use. De-risking strategies may involve discontinuing a relationship on an individual basis or on a sectoral level, which would require breaking off business ties with groupings of clients.

Businesses adopting a sectoral de-risking strategy frequently sever ties with high-risk clients and consumers like foreign correspondent banks (FCBs), money service businesses (MSBs), or embassies. Some countries, in particular, are more affected by de-risking AML practices than others. This is especially true for developing countries with limited financial markets and a higher AML/CFT risk.

Unintended Consequences of De-Risking

The negative repercussions of financial exclusion are clear, and the de-banking of sectors that provide access points to the formal financial sector for underserved populations and jurisdictions exacerbates these issues even further.

Without knowledge about the quantity and variety of accounts being closed, it is difficult to determine which communities are most in danger and to gauge the urgency and scope of the threat, in addition to identifying the industries that are vulnerable to de-risking. Anecdotal evidence indicates that de-risking practices will likely further isolate vulnerable communities, particularly women, from the formal financial sector and may have wide-ranging humanitarian, economic, and security implications.

Many claim that de-risking actually has the opposite effect from what is intended, which is to lessen the vulnerability of the formal financial sector to misuse from money launderers and terrorist funders. Consumers have been forced to rely on smaller banks and credit unions that might not have enough resources to handle higher-risk customers due to the closure of accounts at several major financial institutions. James Richards, a senior AML executive at Wells Fargo, stated that “the paradoxical outcome of de-risking is re-risking... You are delivering them to banks that most likely are unable to handle it.

FATF’s View Of De-Risking

The FATF has some preliminary data that emphasises the importance of identifying the causes and consequences of De-Risking in the private sector. The primary de-risking strategy used by FATF is based on FATF recommendations. As a result, it mandates that financial institutions recognise, comprehend, assess, and put into practice AML/CFT procedures that are proportionate to the risks that have been identified.

Financial institutions must do customer due diligence (CDD) on the defendant bank before establishing correspondent banking relationships. Additionally, financial institutions are obligated to compile enough data about the accountable bank to comprehend the defendant bank’s reputation, operations, and level of supervision, including during a money laundering or terrorism financing inquiry. The FATF Recommendations state that banks affiliated with financial institutions are not required to apply standard customer due diligence (CDD) procedures to their clients when establishing and maintaining correspondent banking relationships. Still, it’s crucial to note that this is not true for high-risk relationships.

De-Risking Programmes

Many banks have created specialised de-risking programmes to explicitly address the requirement to directly depart high-risk clients in bulk. To decide whether to terminate or restrict access, these programmes weigh the possible business benefits of a high-risk relationship against how serious the money laundering danger it poses.

Alternatives to De-Risking AML

De-risking AML is a methodical, economic reaction to money laundering concerns. Still, it lacks the sensitivity and diligence indicated in the risk-based approach to AML, which calls for businesses to seek out and gather information about their clients actively.

De-risking is a desirable alternative because this requirement might be expensive and time-consuming.

However, organisations might lessen or eliminate the need to de-risk by using more cost-effective risk-based AML strategies, hence increasing the accessibility of financial services for potential clients.

In practice, this means enhancing customer due diligence procedures by utilising clever, automated AML/CFT solutions. Innovative technology helps businesses establish effective risk scoring models to prioritise customers better and allocate them to the appropriate AML risk categories, increasing AML screening and monitoring efficiency and accuracy.

How Tookitaki can help

The FATF recommends that financial institutions recognise, comprehend, assess, and put into practice AML/CFT procedures that are proportionate to the risks that have been identified.

Successful CDD and KYC processes rely on a combination of technology and expertise. When risk profiles and criminal threats change, financial institutions must be as agile and creative in their approach to CDD as they are in any other aspect of their AML/CFT strategy. While technology can help with CDD processes, human awareness is still required to recognise and respond to emerging threats.

As regulators are becoming more stringent globally around AML compliance, strengthening the AML systems continues to remain among the top priorities. Tookitaki’s AML solution enables financial institutions to see benefits with dynamic customer risk scoring, leveraging advanced machine learning models for improved effectiveness of CDD with fewer resources.

Request a demo to learn more about our AML solution and its unique features.

Experience the most intelligent AML and fraud prevention platform

Experience the most intelligent AML and fraud prevention platform

Experience the most intelligent AML and fraud prevention platform

Top AML Scenarios in ASEAN

The Role of AML Software in Compliance

Ready to Streamline Your Anti-Financial Crime Compliance?

Our Thought Leadership Guides

Instant Payments, Instant Threats: The New Face of Laundering in Singapore

Singapore has long been a regional hub for financial innovation. But with innovation comes risk — and a recent case involving OCBC and suspected scam syndicates has raised new concerns about how real-time payment systems are being misused for laundering illicit funds. As financial institutions race to offer seamless customer experiences, compliance teams must reckon with the unintended consequences of speed and scale in digital payments.

{{cta-first}}

What Happened: OCBC and the Scam Syndicate Probe

In May 2024, OCBC Singapore confirmed its involvement in a case where law enforcement was investigating multiple individuals for facilitating scam-related transactions. The individuals were believed to have abused real-time fund transfers via OCBC accounts to enable large-scale money laundering for criminal networks. The bank worked closely with authorities, providing transaction data and account activity insights as part of the investigation.

While OCBC was not accused of wrongdoing, the case shed light on how even strong compliance systems can be circumvented when criminals exploit the instant, anonymous, and high-frequency nature of digital transfers.

Impact on Global Finance

This incident is not just a domestic compliance concern — it’s a wake-up call for banks across the region and beyond.

- Global Interconnectedness: In a world of interoperable payment rails and open banking APIs, the misuse of Singapore-based accounts can enable cross-border laundering activities across ASEAN and beyond.

- Increased Regulatory Pressure: Regulators are taking a tougher stance on instant payments. MAS has reiterated the importance of real-time monitoring tools and collaborative data sharing to combat fraud and financial crime.

- Reputational Risk: Incidents like this can erode institutional trust. Singapore has a reputation as a well-regulated financial centre — and banks operating here are expected to go beyond basic compliance to safeguard that trust.

Red Flags and Laundering Tactics in Real-Time Payments

The AFC Ecosystem community has extensively studied real-time payment laundering typologies and found common techniques that criminals rely on:

- QR Code Obfuscation: Criminals embed QR payments within fake e-commerce or empty package delivery schemes to justify fund flows.

- Money Mule Recruitment: Syndicates exploit students, gig workers, and low-income groups to open accounts used for laundering.

- Smurfing at Speed: Instant payments allow layering within seconds across multiple accounts, making tracking difficult.

- Shell Account Structuring: Using prepaid cards, utility accounts, or fake merchant profiles to disperse and reintegrate proceeds.

These methods allow syndicates to create a smokescreen of legitimate-looking transactions that bypass legacy transaction monitoring systems.

Role of Technology in Preventing Future Scandals

Technology must evolve as fast as the financial crime tactics it’s trying to stop. Here’s how institutions can respond:

- Real-Time AI Monitoring: AI-powered transaction monitoring tools that detect velocity, anomalies, and behavioural deviations are no longer optional — they’re essential.

- Federated Intelligence Sharing: Platforms like Tookitaki’s AFC Ecosystem enable banks to tap into collective insights on emerging typologies without compromising data privacy.

- Typology-Based Detection: Monitoring systems must go beyond rules and thresholds. They must ingest real-life scenarios (e.g., QR laundering via empty package schemes) and detect transaction flows that match known patterns.

- Integrated KYC & Risk Scoring: Identity verification must be continuously evaluated, especially for new accounts with sudden activity bursts.

Moving Forward: Learning from the Past, Preparing for the Future

The OCBC incident is a reminder that even strong banks in tightly regulated jurisdictions are not immune. But it’s also an opportunity to rethink how financial institutions tackle fraud and AML in the era of instant payments.

- Collaboration is Key: Financial crime is no longer a siloed problem. Banks, fintechs, regulators, and technology providers must collaborate across borders and platforms.

- Speed ≠ Safety: Instant payments should come with instant safeguards. The speed of money should be matched by the speed of detection.

- Scenario-Led Compliance: A one-size-fits-all rulebook won’t work. Institutions need dynamic compliance systems that reflect real-world typologies contributed by expert communities.

{{cta-whitepaper}}

Final Thoughts

Real-time payment systems are a double-edged sword — offering convenience on one side and risk on the other. The only way to stay ahead is by combining advanced technology, cross-border intelligence, and scenario-led compliance. Tookitaki’s FinCense platform, powered by the AFC Ecosystem, helps financial institutions do just that — with federated AI that continuously evolves to detect new laundering methods faster and more accurately.

The fight against financial crime is real-time. Our defences should be too.

FATF Grey List Shakeup: Laos and Nepal In, Philippines Out

The FATF’s latest grey list update is reshaping financial compliance priorities across Asia, with Laos and Nepal in—and the Philippines out.

Announced in February 2025, this high-stakes shift underscores a growing focus on risk governance, transparency, and regulatory enforcement—particularly in rapidly developing economies.

Whether you’re a compliance lead, fintech founder, or risk officer in APAC, this change raises critical questions: What triggered these decisions? What lessons can be learned from the Philippines’ exit? And how should institutions recalibrate their AML strategies in light of FATF’s evolving lens?

In this article, we break down what the latest grey list update means, how it impacts financial institutions, and how you can stay ahead of the next jurisdictional shift.

{{cta-first}}

What Is the FATF Grey List?

The FATF grey list, officially called the list of jurisdictions under increased monitoring, highlights countries that are actively working with FATF to address strategic deficiencies in their AML/CFT (Anti-Money Laundering and Countering the Financing of Terrorism) regimes.

Greylisting doesn’t mean a country is unsafe or non-cooperative. Instead, it indicates that a jurisdiction has weaknesses in its AML/CFT systems but has committed to resolving them within a set timeframe under FATF supervision.

What Are the Impacts of Greylisting?

- De-risking by global banks and investors

- Tighter scrutiny for cross-border transactions

- Higher due diligence requirements for financial institutions

- Damage to the country’s financial credibility and access to funding

Why Laos and Nepal Were Added in 2025

Laos: Emerging Market, Growing Risk

Laos has seen increased digitisation in its financial sector, but it remains vulnerable to cross-border financial crime, particularly through informal value transfer systems and loosely regulated sectors.

FATF Likely Flagged:

- Inadequate regulation of Virtual Asset Service Providers (VASPs)

- Weak Suspicious Transaction Reporting (STR) frameworks

- Limited transparency around beneficial ownership

- Cross-border risks linked to trade, casinos, and real estate

Nepal: Informality Meets Inattention

Nepal’s dependence on informal remittance corridors and a cash-heavy economy make it a prime candidate for enhanced monitoring.

FATF Concerns Likely Included:

- Weak enforcement of Customer Due Diligence (CDD) standards

- Lack of oversight for DNFBPs (Designated Non-Financial Businesses and Professions)

- Outdated regulatory enforcement and weak supervision

- Poor implementation of targeted financial sanctions

Both countries must now implement time-bound action plans and undergo closer scrutiny from international partners.

The Philippines: From Greylisted to Compliant

After being added to the FATF grey list in June 2021, the Philippines was officially removed in February 2025, following significant improvements across legislation, supervision, and enforcement.

What the Philippines Got Right:

- Established the National Anti-Money Laundering Coordinating Committee (NACC)

- Strengthened AML laws, including the Anti-Terrorism Act of 2020 and FIST Act

- Boosted monitoring of offshore gaming operators, MSBs, and DNFBPs

- Deployed regtech and AI-driven solutions for transaction monitoring

The Philippines' removal demonstrates that FATF listing can be a powerful motivator for change—and that exit is achievable with cross-sector collaboration.

Why This Matters for Financial Institutions

Whether or not your institution operates in Laos, Nepal, or the Philippines, FATF updates are a reminder of the global nature of compliance risk.

Key Impacts:

- Enhanced Due Diligence on clients and transactions involving greylisted jurisdictions

- Recalibration of Risk Scoring Models to reflect changes in country risk profiles

- Correspondent Banking Disruption, especially for cross-border remittances

- Increased Reporting and documentation obligations for flagged activity

Tookitaki's Role in Navigating Greylist Complexity

At Tookitaki, we help financial institutions stay ahead of evolving compliance obligations through intelligent, scalable technology that adapts to FATF expectations.

Our Platform: FinCense

- Scenario-Based Transaction Monitoring with real-time country risk adjustments

- AI-Driven Alert Optimisation to reduce false positives and highlight high-risk activity

- Built-In Typologies contributed by AML experts from across the AFC Ecosystem

- Cross-Border Risk Mapping that flags exposure to greylisted jurisdictions

Whether you operate in a FATF-listed country or do business with one, Tookitaki enables faster response, better decision-making, and audit-ready compliance.

{{cta-whitepaper}}

Lessons from the FATF Grey List Shakeup

For Compliance Teams:

- Update transaction monitoring rules to reflect FATF changes

- Train analysts on new jurisdictional risks

- Use country risk as a dynamic input in risk scoring and alert escalation

For Regulators and Policymakers:

- Benchmark against the Philippines' success story

- Embrace regtech solutions that support real-time adaptation

- Encourage cross-border collaboration and data sharing

Conclusion: Real-Time Compliance for a Real-Time World

The FATF grey list is a dynamic reminder that compliance is not static. With Laos and Nepal now under watch and the Philippines proving that reform is possible, the pressure is on for institutions to respond quickly and proactively.

Tookitaki's technology was built to power that response—turning complex risk into actionable intelligence, and regulatory pressure into an opportunity to lead.

In a world where reputation, trust, and regulation intersect, smart compliance isn't just about avoiding penalties. It's about enabling financial institutions to thrive in the face of uncertainty.

Stay ahead. Stay trusted.

The Philippines’ Road to Exiting FATF’s Grey List by 2025

The Philippines has reached a critical milestone in its fight against financial crime. Being on the FATF grey list is more than just a regulatory classification—it impacts global investor confidence, banking partnerships, and cross-border transaction efficiency. However, after years of reforms, the country is now poised for a historic turnaround.

Since June 2021, this designation has increased scrutiny from global regulators and financial institutions, affecting foreign investments and the ease of international transactions. However, in its October 2024 report, FATF acknowledged the significant progress made by the Philippines—a clear signal that the country is on track to exit the grey list by 2025.

But what does this mean for banks and fintechs operating in the Philippines?

How the Philippines Earned FATF Recognition

The Philippines has made significant strides in strengthening its anti-money laundering (AML) and counter-terrorism financing (CTF) frameworks, earning international recognition and progressing toward FATF grey list removal.

1. Completion of FATF’s 18-Point Action Plan

The Anti-Money Laundering Council (AMLC), in collaboration with various financial regulators, has effectively addressed all 18 action items outlined by the FATF. Key achievements include:

✅ Risk-Based Supervision: Enhanced supervision of Designated Non-Financial Businesses and Professions (DNFBPs) to ensure full AML/CTF compliance.

✅ Casino Sector Oversight: Implemented stringent AML/CTF controls to mitigate risks associated with casino junket operations and high-risk transactions.

✅ Regulation of Money Service Businesses: Established new registration requirements and imposed sanctions on unregistered and illegal remittance operators.

✅ Beneficial Ownership Transparency: Improved law enforcement access to beneficial ownership data, reducing the misuse of shell companies.

✅ Financial Intelligence Utilization: Increased use of AI-powered financial intelligence in investigating and prosecuting money laundering and terrorist financing cases.

✅ Non-Profit Organization Safeguards: Introduced measures to prevent the misuse of NGOs for terrorist financing activities.

✅ Targeted Financial Sanctions: Strengthened frameworks for sanctions implementation on terrorism and proliferation financing.

{{cta-first}}

2. Implementation of the National AML/CTF Strategy (NACS) 2023-2027

In July 2023, President Ferdinand R. Marcos Jr. issued Executive Order No. 33, mandating the adoption of the National Anti-Money Laundering, Counter-Terrorism Financing, and Counter-Proliferation Financing Strategy (NACS) 2023-2027).

This strategy fosters collaboration between government agencies, financial institutions, and stakeholders. Key components include:

✅ Inter-Agency Coordination: Formation of the National AML/CTF/CPF Coordinating Committee (NACC) to oversee policy development and execution.

✅ Risk Assessment and Management: Regular money laundering and terrorist financing risk evaluations to drive policy responses.

✅ Capacity Building: Strengthening AML training programs and allocating resources to law enforcement agencies.

✅ Public Awareness: Raising financial crime awareness through AML education programs.

3. Strengthening International Collaboration

The Philippines has worked with international partners to align its AML/CTF frameworks with global best practices. Notable collaborations include:

✅ United Nations Office on Drugs and Crime (UNODC): Provided technical assistance and inter-agency coordination support, enhancing law enforcement cooperation.

✅ International Monetary Fund (IMF): Acknowledged the Philippines' AML progress and emphasized the need for sustained reforms.

✅ Government of Japan: Facilitated AML/CTF capacity-building initiatives, improving compliance capabilities.

What FATF Grey List Removal Means for Banks & Fintechs

1. Greater Global Trust & Investment

✅ Restored investor confidence, attracting more foreign capital into the banking and fintech sectors.

✅ Stronger global banking partnerships, reducing compliance-related transaction frictions.

✅ Expanded market access for fintech firms seeking regional and cross-border growth.

2. Lower Compliance Costs & Faster Transactions

✅ Reduced transaction monitoring costs, as FATF-imposed restrictions ease.

✅ Faster cross-border payments due to relaxed correspondent banking restrictions.

✅ Better financial institution partnerships, improving global connectivity.

3. Stronger Compliance Standards

✅ Stricter transaction monitoring & real-time fraud detection.

✅ Advanced AML screening mechanisms for high-risk accounts.

✅ Tougher financial crime penalties, ensuring deterrence and compliance sustainability.

4. Growth Opportunities for Fintech & Digital Payments

✅ Unlocks fintech expansion into digital lending & payments.

✅ Facilitates partnerships with global payment networks and neobanks.

✅ Accelerates AI-powered compliance adoption to enhance AML processes.

5. Heightened Scrutiny & Tougher Enforcement Against Non-Compliance

✅ Regulators will impose stricter audits and higher penalties for compliance failures.

✅ Financial institutions must enhance AI-driven transaction monitoring for real-time risk detection.

✅ Automated STR filing and advanced case investigations will be crucial for compliance efficiency.

{{cta-whitepaper}}

Final Thoughts: A Future-Ready Philippines

The Philippines is making strong progress toward exiting the FATF grey list, but sustained compliance efforts are essential to ensuring long-term financial integrity. While the country's reforms have boosted investor confidence and regulatory trust, banks and fintechs must remain vigilant to avoid any setbacks. This transition presents opportunities for financial institutions, including greater access to global markets, lower compliance risks, and a more resilient financial ecosystem. However, the increased scrutiny following grey list removal means that institutions must continue strengthening their AML frameworks, deploying AI-driven transaction monitoring, and enhancing fraud detection mechanisms. With Tookitaki’s FinCense platform, financial institutions can future-proof their AML compliance strategies, ensuring accuracy, efficiency, and regulatory alignment in a post-grey list environment. As the Philippines moves forward, proactive compliance and continuous improvement will be key to maintaining global credibility and financial stability.

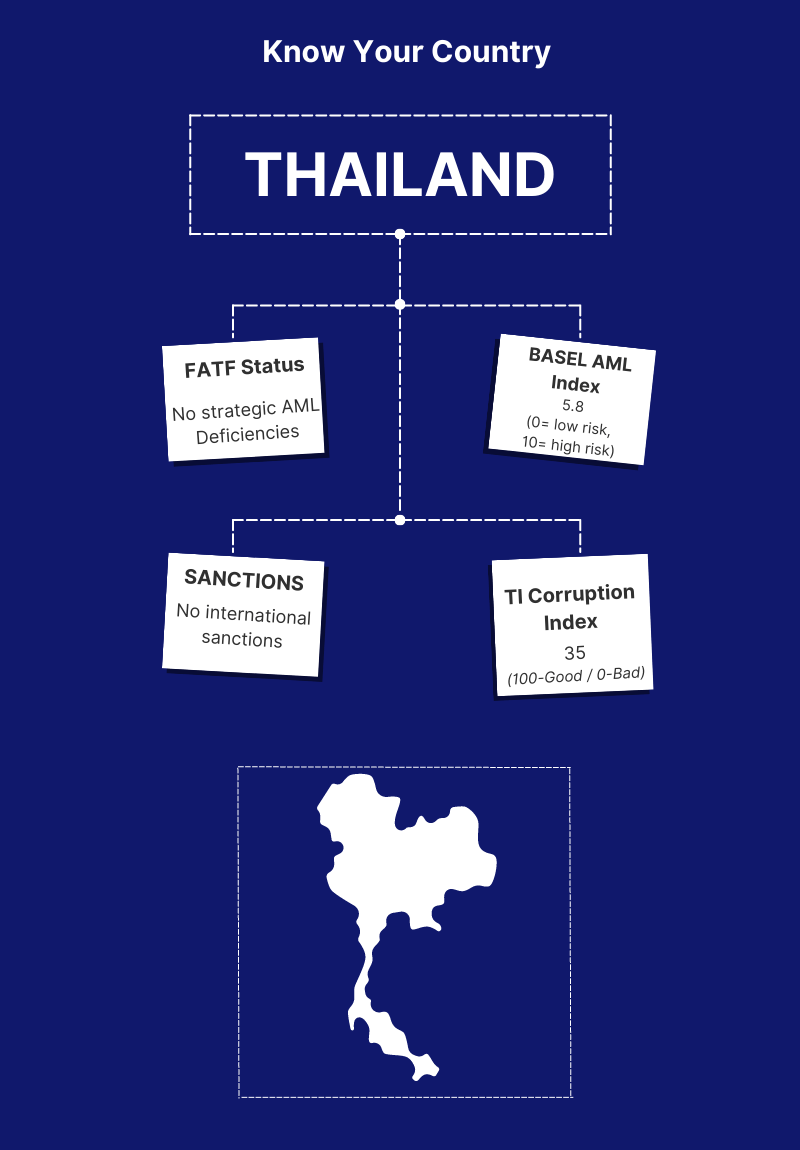

The Benefits of Using Tookitaki's Solution for AML Compliance in Thailand

In today's global financial landscape, anti-money laundering (AML) compliance plays a crucial role in ensuring the integrity of financial systems and preventing illicit activities. As a growing hub for international business and finance, Thailand recognises the significance of AML compliance in maintaining a secure and trustworthy financial environment. Compliance with AML regulations is a legal obligation and a means to protect financial institutions, customers, and the overall economy from the risks associated with money laundering and financial crime.

Tookitaki has emerged as a prominent provider of AML compliance solutions, empowering financial institutions in Thailand and across the globe to tackle the challenges of financial crime effectively. With their innovative technology and expertise in AML compliance, Tookitaki offers comprehensive solutions that enhance detection, reduce false positives, and streamline compliance processes.

By leveraging advanced technologies, Tookitaki enables financial institutions to stay ahead of evolving threats and confidently maintain regulatory compliance. Their commitment to excellence and customer-centric approach make them a trusted partner for organisations striving for robust AML compliance in Thailand.

AML Compliance Landscape in Thailand

Overview of the Regulatory Framework for AML in Thailand

Thailand has implemented a comprehensive regulatory framework to combat money laundering and financial crime. Key regulatory bodies and guidelines include:

- Anti-Money Laundering Office (AMLO): The primary authority responsible for implementing AML policies and regulations in Thailand.

- Anti-Money Laundering Act (AMLA): Legislation that sets out the legal framework for AML compliance and enforcement.

- Know Your Customer (KYC) Regulations: Guidelines that require financial institutions to verify customer identities, assess risk profiles, and conduct due diligence.

- Reporting Obligations: Requirements for financial institutions to report suspicious transactions and adhere to transaction monitoring practices.

Challenges Faced by Financial Institutions in Achieving AML Compliance

Financial institutions operating in Thailand encounter several challenges in achieving AML compliance, including:

- Evolving Regulatory Landscape: Adapting to changing AML regulations and guidelines can be a daunting task for financial institutions, as it requires a significant amount of resources, time, and effort. Regulations and guidelines are constantly evolving, and it can be challenging to keep up with the changes and ensure that compliance measures are up-to-date. Additionally, compliance teams must navigate a complex web of regulations and guidelines issued by various regulatory bodies, making compliance a multifaceted and intricate process.

- High False Positive Rates: Traditional AML systems often generate a high volume of false positives, resulting in increased manual effort and operational costs. False positives can occur due to various reasons, such as outdated technology, insufficient data analysis, or rigid rule-based systems that fail to adapt to changing circumstances. These false alerts not only add to the workload of compliance teams but also increase the risk of missing genuine threats. Furthermore, manually reviewing each alert can be time-consuming and costly, leading to delays in investigations and potentially putting the institution at risk of regulatory penalties.

- Rapidly Evolving Financial Crimes: Financial criminals are constantly evolving their tactics to stay ahead of AML systems. They are becoming increasingly sophisticated in their methods, utilizing complex networks of shell companies, cryptocurrencies, and other innovative techniques to hide their illicit activities. This requires financial institutions to be proactive in their approach to AML compliance and stay ahead of emerging threats.

- Resource Constraints: Financial institutions operating in today's dynamic market face a plethora of challenges, including resource constraints. The shortage of skilled personnel, outdated technology infrastructure, and limited financial resources can impede the institution's ability to effectively combat money laundering and financial crime. The hiring and retention of skilled compliance professionals can be costly and challenging, while outdated technology infrastructure can limit the institution's ability to leverage advanced technologies like machine learning. Additionally, limited financial resources can result in budget constraints, preventing the institution from investing in the latest AML solutions.

The Need for Effective and Efficient AML Solutions in the Thai Market

Given the challenges financial institutions face, there is a pressing need for effective and efficient AML solutions in the Thai market. These solutions should offer the following:

- Enhanced Detection Accuracy: AML solutions must leverage advanced technologies like machine learning to improve detection accuracy and reduce false positives.

- Streamlined Compliance Processes: Automation and intelligent workflows can help streamline compliance processes, minimizing manual effort and improving operational efficiency.

- Regulatory Compliance: AML solutions should align with the Thai regulatory framework, enabling financial institutions to meet their compliance obligations.

- Scalability and Adaptability: Solutions should be scalable to accommodate business growth and adaptable to evolving AML regulations and emerging financial crime trends.

Tookitaki's AML compliance solutions address these needs, providing financial institutions in Thailand with the tools and capabilities necessary to overcome AML compliance challenges effectively.

Tookitaki's AML Solution for Thailand

Tookitaki offers a comprehensive AML solution -- the Anti-Money Laundering Suite (AML Suite) -- that empowers financial institutions in Thailand to combat money laundering and financial crime effectively. Its solution combines advanced machine learning algorithms, data analytics, and automation to enhance detection accuracy, streamline compliance processes, and ensure regulatory compliance.

The AML Suite operates as an end-to-end operating system, covering various stages of the compliance process, from initial screening to ongoing monitoring and case management. Banks and fintechs can achieve a seamless workflow, eliminate data silos, and ensure consistent compliance across different modules by having a cohesive and integrated system. The end-to-end approach enhances operational efficiency, reduces manual efforts, and facilitates a more holistic view of AML compliance, enabling financial institutions to stay ahead of evolving risks.

Modules within the AML Suite

Smart Screening Solutions

- Prospect Screening: This module enables real-time screening capabilities for prospect onboarding. By leveraging smart, AI-powered fuzzy identity matching, it reduces regulatory compliance costs and exposure to risk. Prospect Screening helps financial institutions detect and prevent financial crime by screening potential customers against various watchlists, including sanctions lists, PEP databases, and adverse media. The solution provides efficient and streamlined screening processes, reducing false positive hits and assisting compliance specialists in various scenarios.

- Name Screening: Tookitaki's Name Screening solution utilizes machine learning and Natural Language Processing (NLP) techniques to accurately score and distinguish true matches from false matches across names and transactions, in real-time and batch mode. The solution supports screening against sanctions lists, PEPs, adverse media, and local/internal blacklists, ensuring comprehensive coverage. With 50+ name-matching techniques, support for multiple attributes like name, address, gender, and a built-in transliteration engine, Name Screening provides razor-sharp matching accuracy. The state-of-the-art real-time screening architecture reduces held transactions and improves straight-through processing (STP) for a seamless customer experience.

Dynamic Risk Scoring

- Prospect Risk Scoring: Prospect Risk Scoring (PRS) is a powerful solution that enables financial institutions to onboard prospects with reduced regulatory compliance costs and risk exposure. By defining a set of parameters that correspond to the rules, PRS offers real-time risk scoring capabilities. Financial institutions can leverage PRS to take initial scope, including factors such as address, nationality, gender, occupation, monthly income, and more, into account for risk scoring. The configurable scores for risk categories allow financial institutions to streamline the prospect onboarding process, make informed decisions, and mitigate risks effectively.

- Customer Risk Scoring: Tookitaki's Customer Risk Scoring (CRS) is a core module within the AML Suite, powered by advanced machine learning. CRS provides scalable customer risk rating by dynamically identifying relevant risk indicators across a customer's activity. The solution offers a 360-degree customer risk profile, continuous on-demand risk scoring, and perpetual KYC for ongoing due diligence. With actionable insights based on customer risk scores, financial institutions can make accelerated and informed decisions, ensuring effective risk mitigation.

Transaction Monitoring

Tookitaki's Transaction Monitoring solution is the most comprehensive in the industry, utilizing a first-of-its-kind industry-wide typology repository and AI capabilities. It provides comprehensive risk detection and efficient alert management, offering 100% risk coverage and the ability to detect new suspicious cases. The solution includes automated threshold management, reducing the manual effort involved in threshold tuning by over 70%. With superior pattern-based detection techniques, leveraging typologies that represent real-world red flags, Transaction Monitoring helps financial institutions safeguard against new risks and threats effectively.

Case Manager

The Case Manager within Tookitaki's AML Suite provides compliance teams with a collaborative platform to work seamlessly on cases. The Case Manager includes automation that empowers investigators by automating processes such as case creation, allocation, and data gathering. Financial institutions can configure the Case Manager to improve operational efficiency, reduce manual efforts, and enhance overall effectiveness in managing and resolving cases.

{{cta-ebook}}

Ensuring Compliance with Thai Regulatory Requirements

Tookitaki's solution is designed to align with the regulatory framework and requirements set by the Anti-Money Laundering Office (AMLO) and the Anti-Money Laundering Act (AMLA) in Thailand. By using Tookitaki's solution, financial institutions can ensure adherence to these regulations, reducing compliance risks and potential penalties.

Overall, the benefits of using Tookitaki's solution for AML compliance in Thailand extend beyond improved detection accuracy and streamlined processes. Financial institutions can achieve significant cost savings, optimize resource allocation, and maintain compliance with Thai regulatory requirements, enabling them to effectively combat money laundering and protect their operations and customers from financial crime risks.

Final Thoughts

Tookitaki's solution offers numerous advantages for financial institutions seeking robust AML compliance in Thailand. The benefits include enhanced detection accuracy, streamlined compliance processes, cost savings, and ensuring adherence to Thai regulatory requirements. By leveraging Tookitaki's advanced technology, financial institutions can effectively combat money laundering and financial crime while optimizing operational efficiency and resource allocation.

In today's dynamic and rapidly evolving financial landscape, traditional approaches to AML compliance are no longer sufficient. Financial institutions must harness the power of advanced technology to stay ahead of emerging threats and meet regulatory obligations effectively. Tookitaki's innovative solution combines machine learning, data analytics, and automation to provide comprehensive AML compliance capabilities tailored to the specific needs of the Thai market.

Tookitaki is a trusted partner for financial institutions in Thailand, offering cutting-edge AML compliance solutions. Financial institutions are encouraged to explore Tookitaki's solution further, understand its features and benefits, and book a demo to experience firsthand how it can transform their AML compliance processes. By leveraging Tookitaki's solution, financial institutions can strengthen their defence against money laundering, protect their reputation, and safeguard their customers and the financial ecosystem in Thailand.

.webp)

Tookitaki: Reflecting on a Transformative 2024

As we close out 2024, it’s time to reflect on a year of remarkable achievements and progress. From driving innovation to deepening partnerships and expanding our reach across Asia-Pacific and beyond, Tookitaki has continued to evolve with a steadfast commitment to its mission of building trust in financial services.

In an increasingly complex financial crime landscape, our ability to innovate and adapt has strengthened our position as a trusted partner to institutions navigating these challenges. Here’s a look back at the milestones that defined Tookitaki’s journey in 2024.

1. 2024: A Year of Evolution

This year was defined by resilience, innovation, and growth as Tookitaki strengthened its leadership in anti-money laundering (AML) and fraud prevention. With financial crime becoming increasingly sophisticated, we continuously evolved our solutions to address the complex needs of financial institutions across Asia and beyond.

Tookitaki emerged as a category leader in Watchlist Screening, Enterprise Fraud, Payment Fraud, and AML TM Quadrants of Chartis, underscoring the depth and maturity of our FinCense platform. We also received accolades from Juniper Research (Banking Fraud Prevention Innovation 2024) and Regulation Asia - Best Transaction Monitoring Solution (Fraud & Financial Crime Category), Asian Banking and Finance Award (Winner of the AI-Powered Analytics and RegTech Initiative Award) and were honoured by the prestigious ASEAN Business Advisory Council at the ASEAN Business Awards 2024.

These recognitions validate our unique approach of combining collaborative intelligence from the AFC Ecosystem with the Federated AI capabilities of FinCense. By enabling financial institutions to leverage real-world scenarios while safeguarding data privacy, we have empowered them to adapt to evolving financial crime threats more effectively and at scale.

2. Commitment to Our Mission

At Tookitaki, our mission is to build trust in financial services by enabling institutions to combat fraud and meet AML compliance standards effectively.

In 2024, we significantly enhanced our platform to address critical threats such as account takeovers, mule networks, scams, and the misuse of shell companies. These advancements have equipped institutions to confidently navigate complex regulatory landscapes while strengthening trust with their stakeholders. As a testament to our impact, Tookitaki is now a partner of choice for at least one of the top three financial institutions in most Asia-Pacific countries.

3. Key Innovations and Technology

Innovation drives everything we do at Tookitaki. This year, we introduced critical advancements to address evolving challenges:

- FinCense Platform: We delivered major enhancements in dynamic risk scoring, real-time fraud detection, and enhanced regulatory reporting, equipping institutions with tools to streamline compliance workflows and stay ahead of emerging threats.

- Infrastructure Upgrades: This year, we made transformative enhancements to our FinCense platform, cutting deployment time by 50% through streamlined processes and standardisation. Reliability has been boosted to 99.95% uptime using a containerised microservices architecture, ensuring seamless operations. To further optimise efficiency, we introduced dynamic resource scaling and decoupled storage and computing, minimising infrastructure requirements even during peak periods.

These innovations empower our clients to build proactive, scalable compliance systems that adapt to the fast-changing financial crime landscape.

4. Compliance-as-a-Service: Enabling Scalable, Seamless Compliance

We launched Compliance-as-a-Service (CaaS) in 2023 to complement our on-premise deployment, offering financial institutions a flexible and scalable alternative. This year, CaaS gained significant momentum, with client go-live rates increasing by 50% in H2 compared to H1, reflecting its growing adoption and trust across the region.

We are leveraging our strategic partnerships with AWS and Google Cloud Platform (GCP) to deliver CaaS solutions across Asia-Pacific and Saudi Arabia, ensuring robust compliance infrastructure tailored to regional needs. This progress marks a pivotal shift as larger banks are increasingly embracing CaaS as their preferred compliance framework.

5. Client Milestone

This year, Tookitaki solidified its leadership in Asia-Pacific, working with at least one of the top three financial institutions in most countries across the region. Our partnerships with industry leaders such as UOB (Singapore), Maya Bank (Philippines), Fubon Bank (Taiwan), AEON Bank (Malaysia), GXS Bank (Singapore), and Tencent (Singapore) reflect the trust placed in us to address critical compliance challenges.

These collaborations highlight Tookitaki’s growing influence in delivering cutting-edge compliance solutions tailored to the needs of some of the most prominent institutions in Asia.

6. Community of Innovators

The AFC Ecosystem embodies the power of collaboration in fighting financial crime. Tookitaki continued to lead industry collaboration through its AFC Ecosystem, fostering a community of AML and fraud prevention specialists and financial institutions to collectively combat financial crime.

In 2024, we hosted knowledge-sharing initiatives to address emerging crime typologies. We expanded our scenario library significantly, enabling financial institutions to detect and mitigate emerging threats proactively. We grew our consortium by joining associations like ABCOMP, Fintech Philippines Association, FinTech Association of Hong Kong, Fintech Association of Malaysia (FAOM), and AICB, building one of the largest communities for financial crime prevention in Asia.

Also, our AFC Ecosystem community delivered unparalleled value this year, contributing a new financial crime scenario every second day.

7. Strategic Partnerships

Collaboration has been a cornerstone of our success. This year, Tookitaki further expanded its extensive partner ecosystem to better meet the bespoke compliance needs of financial institutions across the Asia-Pacific region. By deepening our collaboration with key advisory partners like Arthur D. Little, SIA and strengthening cloud partnerships with AWS and Google Cloud Platform (GCP), we have enhanced our ability to deliver tailored solutions at scale.

These partnerships ensure we can deliver tailored, scalable, and region-specific solutions, empowering institutions to address complex financial crime challenges with greater efficiency.

8. Fueling Innovation: New Investments, Deeper Commitments

Earlier this year, we welcomed TGV as a new investor, marking a significant milestone in our journey to revolutionise compliance. This investment strengthens our ability to scale operations, advance our technology, and tackle the evolving challenges of financial crime with precision and agility. It reflects the trust and confidence of our partners and stakeholders in Tookitaki’s vision to build resilient and scalable compliance solutions that address the most pressing compliance challenges of today and tomorrow.

Closing Note

To our clients, partners, and stakeholders: thank you for being an integral part of this journey. Together, we are building the Trust Layer for Financial Services, reshaping the way financial systems combat crime while building resilience. This mission is more than a vision—it’s a shared responsibility that inspires us every day. Here’s to a 2025 filled with innovation, collaboration, and a safer financial ecosystem for all!

A New Era of Cyber Scams in Southeast Asia: How Banks Can Respond

Cyber scams are becoming smarter and harder to detect. Southeast Asia has become a hotspot for fraud factories, where advanced technology is used to trick victims and steal billions of dollars.

These scams are not just hurting individuals but also putting banks and financial systems at risk.

Financial institutions in Southeast Asia must act quickly to protect themselves and their customers. Using smarter tools and strategies is the key to staying ahead of these threats.

Understanding the Threat Landscape: Modern Scam Tactics

A. Romance Scams

Romance scams are a growing threat in Southeast Asia. Scammers build trust with their victims by pretending to be friends, romantic partners, or business associates. Once trust is gained, they convince victims to invest in fake schemes and then steal their money.

These scams have caused massive losses worldwide. In 2023, Americans alone lost $3.5 billion to scams, many of which originated from Southeast Asia, according to the United States Institute of Peace (USIP).

B. Social Engineering

Recent social engineering schemes involve fake videos or voices to trick people. Scammers impersonate family members, celebrities, or officials to steal money or sensitive information.

Between 2022 and 2023, social engineering scams involving deepfakes in the Asia-Pacific region increased by a shocking 1,530%, as reported by the UNODC. This makes it one of the fastest-growing threats in the world.

C. Money Muling and Money Laundering

Scammers also rely on “money mules” to move stolen money. These are individuals, sometimes unaware, who help launder funds and make it harder for authorities to track the crimes.

This adds another layer of complexity for financial institutions, making anti-money laundering (AML) compliance even more challenging.

{{cta-first}}

Challenges for Banks and Financial Institutions

Banks in Southeast Asia face serious challenges in fighting modern cyber scams. Scammers are using advanced tools like deepfake technology and malware, which are difficult to detect with traditional systems.

Many banks also struggle with a flood of false positives from their fraud detection systems. This wastes time and resources, making it harder to focus on real threats.

Another big challenge is the lack of information sharing between institutions. Scammers often exploit these gaps to avoid detection, targeting multiple banks with the same tactics.

Finally, as scams grow more complex, staying compliant with anti-money laundering (AML) regulations becomes harder. This increases the risk of penalties and damage to a bank’s reputation.

Strategies for Financial Institutions to Combat Cyber Scams

A. Leveraging Advanced Technology

Banks need to invest in advanced tools like artificial intelligence (AI) and machine learning to stay ahead of scammers. These technologies can analyze patterns in real-time and detect suspicious activities faster than traditional systems.

Real-time monitoring systems are especially important. They allow banks to quickly identify and respond to new threats, reducing the chances of scams succeeding.

B. Enhancing Collaboration and Intelligence Sharing

Collaboration is key to fighting scams that cross borders. Banks, governments, and law enforcement agencies must share information to stay ahead of evolving threats.

Global initiatives like INTERPOL’s anti-scam operations and ASEAN-led efforts provide useful models. By working together, institutions can strengthen their defenses and close the gaps that scammers exploit.

C. Strengthening Internal Systems

Banks should improve internal systems like KYC (Know Your Customer) and transaction monitoring. This helps in identifying high-risk individuals and stopping fraudulent activities before they escalate.

Training staff to recognize new scam tactics is equally important. Well-informed teams can act quickly and prevent losses.

D. Raising Awareness Among Customers

Educating customers is a crucial part of preventing scams. Awareness campaigns can teach people to spot fake investment platforms, deepfake videos, and phishing attempts.

In Singapore, the government launched “CheckMate,” a WhatsApp bot that helps users identify scams. Programs like this can empower customers to protect themselves against fraud.

{{cta-ebook}}

The Role of Policy and Regulation in Tackling Fraud

Governments and regulators play a critical role in combating cyber scams. Clear policies and strong enforcement can help disrupt scam operations and protect financial systems.

Existing regulations, like those requiring banks to follow strict anti-money laundering (AML) measures, need regular updates to address new threats. Technologies like AI-driven fraud require targeted policies to ensure scammers cannot misuse them.

Global cooperation is essential to tackle scams that operate across borders. For example, INTERPOL and ASEAN initiatives help countries work together to fight scams. Governments must also focus on holding companies accountable, such as social media platforms and cryptocurrency exchanges, which are often used by scammers.

Raising public awareness through regulations can also help reduce the impact of scams. Programs like Singapore’s CheckMate bot are good examples of how governments can support prevention efforts.

Conclusion: Building Resilience with Intelligent Solutions

Cyber scams, from romance scams to money mules, are evolving rapidly and threatening financial institutions across Southeast Asia. Banks must stay one step ahead by adopting smarter tools, improving internal processes, and collaborating with other stakeholders.

Building resilience requires a combination of advanced technology, global cooperation, and public awareness. Innovative platforms like Tookitaki can empower financial institutions to tackle these threats effectively by offering comprehensive and intelligent solutions for fraud and money laundering prevention.

To secure the future of banking, financial institutions must act now. By leveraging the right tools and strategies, they can protect their customers, stay compliant, and maintain trust in a rapidly changing world.

.svg)